Fraud prevention in payment services

Fraud is a major and expanding societal problem that fosters organised crime. FI supervises that payment service providers follow the provisions set out in the Payment Services Act that aim to prevent fraud. Payment service providers do a lot to prevent their payments services from being used for fraud, but this problem is still growing.

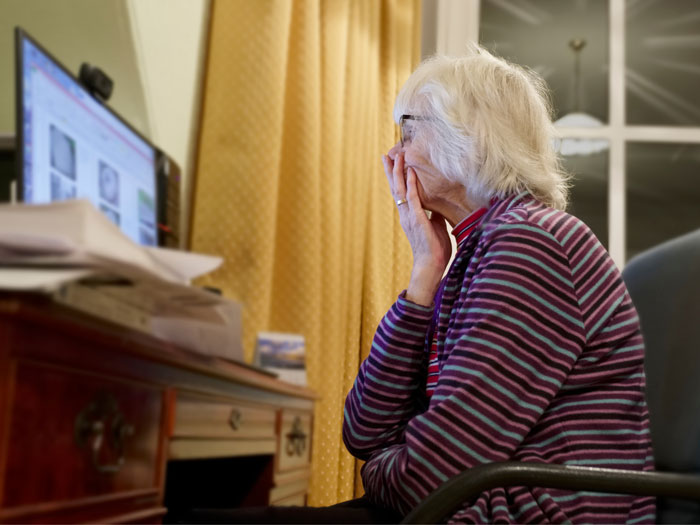

The occurrence of fraud in conjunction with some kind of payment service is escalating. During the second half of 2023, it reached the highest measured levels yet, SEK 1.1 billion, which is more than three times the amount reported in the second half of 2020. Because payment service providers have improved their security functions, fraudsters are focusing on manipulating consumers (payment service users) rather than taking advantage of security deficiencies in the payment services. The data also shows that fraud through so-called social manipulation has increased the most and represents the largest share of illicitly obtained gains; fraud from account transfers represents 85 per cent of this amount. If a consumer has been convinced through social manipulation to willingly conduct an authorised transaction, they often have no recourse. This means that the majority of losses that arise through fraud are currently borne by consumers. Older consumers are more frequent victims.

FI supervises that payment service providers follow the provisions set out in the Payment Services Act that aim to prevent fraud. FI considers the risk that payment service providers' products and services can be used for fraud in both its risk identification process and prioritisation of supervisory measures, as well as in the dialogue it maintains with the payment service providers in the ongoing supervision. As part of this supervision, we are also following up on reports from the payment service providers about identified fraud.

The payment service providers do a lot to prevent payment services from being used for fraud, but the fact that the problem is escalating shows that more needs to be done. FI makes the assessment, for example, the payment service providers need to develop their products and services to increase security and thereby better protect their customers. Banks, through the Swedish Bankers' Association, recently presented measures to improve security and strengthen customer protection, which FI welcomes.

FI makes the assessment that the legislation presents grounds on which to strengthen the requirements on payment service providers. Within the EU, work is under way to reform the payment services legislation. The proposal contains several measures that aim to combat fraud from social manipulation. FI believes that these measures will be helpful, in part through increased requirements on transaction monitoring.